Enjoy the article? Download your free copy at the bottom of the page today!

Overview

A qualified charitable distribution (QCD) allows individuals age 70½ and older to donate up to $108,000 in 2025 (an amount that is adjusted each year for inflation) to public charities directly from an IRA. QCDs can be an effective way to give to charity as well as reduce your tax bill, since they are excludable from taxable income. Once you reach the age when required minimum distributions (RMDs) kick in, a QCD can be used to satisfy all or a portion of the RMD that is due from an IRA.

There are numerous tax rules to consider before initiating a QCD. That’s why we recommend discussing this strategy with your advisor and a tax professional before taking any action.

Who can benefit from a QCD?

IRA owners who are at least age 70½, who have

charitable giving intentions and do not fully need the

RMDs to support their lifestyle may want to consider

a QCD, since it can offer potential tax savings.

Examples of investors who may find QCDs useful

include those who:

- Are focused on tax bracket management strategies (for example, they would like to reduce the balance in an IRA to lower future RMDs).

- Would benefit more from an exclusion of income versus an itemized deduction.

- Would like to make a larger charitable gift than they could if they simply donated cash or other assets.

- Typically give appreciated securities to charities, but due to market conditions or other factors would rather use other resources to fulfill their charitable goals.

How does it work?

In general, a QCD can only be done from an IRA.

Generally, QCDs are allowed from traditional IRAs and

inherited IRAs (in some cases SEP or SIMPLE plans

may qualify if they are inactive) as long as you are age

70½ or older when the transfer happens. However,

employer-sponsored retirement accounts, including

401(k), 403(b), and active SEP and SIMPLE accounts,

are not eligible for a QCD.

Special onetime donation. Investors can also make a

onetime QCD of up to $54,000 in 2025 to charities via

a charitable gift annuity, charitable remainder unitrust,

and charitable remainder annuity trust.

The QCD is per individual. For a married couple, each

person can distribute up to $108,000 for 2025 from their IRA. Any amount over the annual limit is treated as a normal distribution and included in taxable income. In such cases, that excess can be included as an itemized deduction under charitable donations.

A QCD must be directly transferred to a qualified

charity. Investors should request that the IRA custodian send a check directly to the charity. If the check is paid out to you, the distribution won’t be recorded as a QCD and will be considered a taxable distribution.

A QCD can satisfy all or a portion of your RMD that is due from an IRA. However, for this to work, there must be a RMD remaining. The first withdrawals out of an IRA are considered to be your RMD. If the withdrawal is not designated as a QCD, it cannot be re-designated as a QCD after the fact, so plan ahead when taking RMDs. Furthermore, IRA aggregation RMD rules apply.

- A QCD can be less than the full RMD. The IRS does not require that 100% of the RMD be used for a QCD. A portion can be used for other purposes or invested.

- A QCD can be more than the full RMD. You can take a QCD in excess of your RMD, however the extra distribution cannot be carried over to cover future-year RMDs.

- To maximize the tax benefit of a QCD, coordinate your first withdrawals with your QCD, then take any additional RMDs if needed

QCDs cannot be used with DAFs or private

foundations. Under current federal law, donor advised funds (DAFs) and private foundations are not

considered qualified charities for a QCD, even though

they are 501(c)(3) charitable organizations for all

other donations.

QCDs are only eligible for outright donations. QCDs

cannot be used in exchange for benefits such as tickets to sporting events, dinners, events, or other services.

QCDs are not tax deductible. QCDs are reported on your tax return but the amounts do not count towards taxable income. If you take advantage of a QCD, it does not preclude you from giving to charity in traditional ways that provide you with an itemized deduction. Charitable-minded people can use multiple giving approaches each year. A well-thought-out charitable planning strategy is essential to maximize your giving and tax benefits.

To cover your RMD, a QCD must be done by December 31. However, don’t wait until December 31 to do one. Allow enough processing time for any QCD

requests from your IRA custodian..

What’s the potential tax savings?

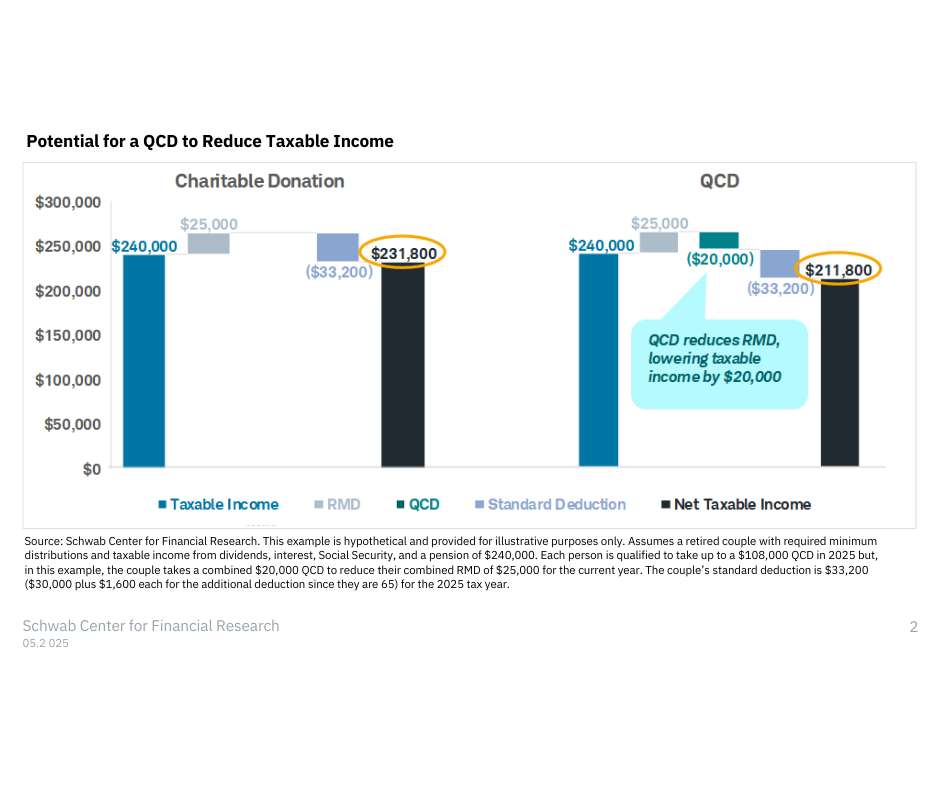

Let’s look at a simple example. Say a retired couple has

$240,000 of income from various sources (dividends,

interest, Social Security, and a pension). They also have

a $25,000 RMD that needs to be taken, which would

increase their income to $265,000. They would like to

donate $20,000 to one of their favorite charities.

However, even with this donation, they will still end up

taking the standard deduction of $33,200 for 2025

(married filing jointly standard deduction of $30,000 and additional deduction of $1,600 per person 65 or older).

If a $20,000 QCD is used to reduce the couple’s

$25,000 RMD, they would have $211,800 of taxable

income ($240,000 annual income + $5,000 RMD =$245,000 – standard deduction of $33,200 = $211,800). If they make the donation directly in the form of cash, without a QCD, the $25,000 RMD will increase their net taxable income to $231,800 ($240,000 annual income + $25,000 RMD = $265,000 – standard deduction of $33,200 = $231,800). With a 24% marginal tax rate, the difference in taxable income from a QCD could result in tax savings of $4,800 for the couple. (See the chart on page 2.)

What are the planning implications of a QCD?

Taking a QCD before the year you are required to take your first RMD can reduce future RMDs. A QCD is only allowed if the distribution is made on or after the date you turn age 70½, making a QCD possible a few years before RMDs kick in. (RMDs must be taken the year you turn 73, and 75 beginning in 2033). As a result, QCDs

can be used in these run-up years to reduce the IRA balance subject to future RMDs.

QCDs won’t impact the taxability of Social Security benefits and Medicare premiums. You can avoid higher

(modified) adjusted gross income by using a QCD to offset a RMD, which means additional tax on Social Security benefits and higher Medicare premiums could be avoided.

Use a QCD on top of your itemized charitable deductions. Charitable contributions are limited to a percentage of your adjusted gross income (AGI), which can vary from 60% for cash donations to 30% for donations of appreciated assets. Since QCDs are not subject to the AGI limitations, you can use a QCD to give more to charities, even if you have given the maximum amount allowed for your itemized deductions.

Case study

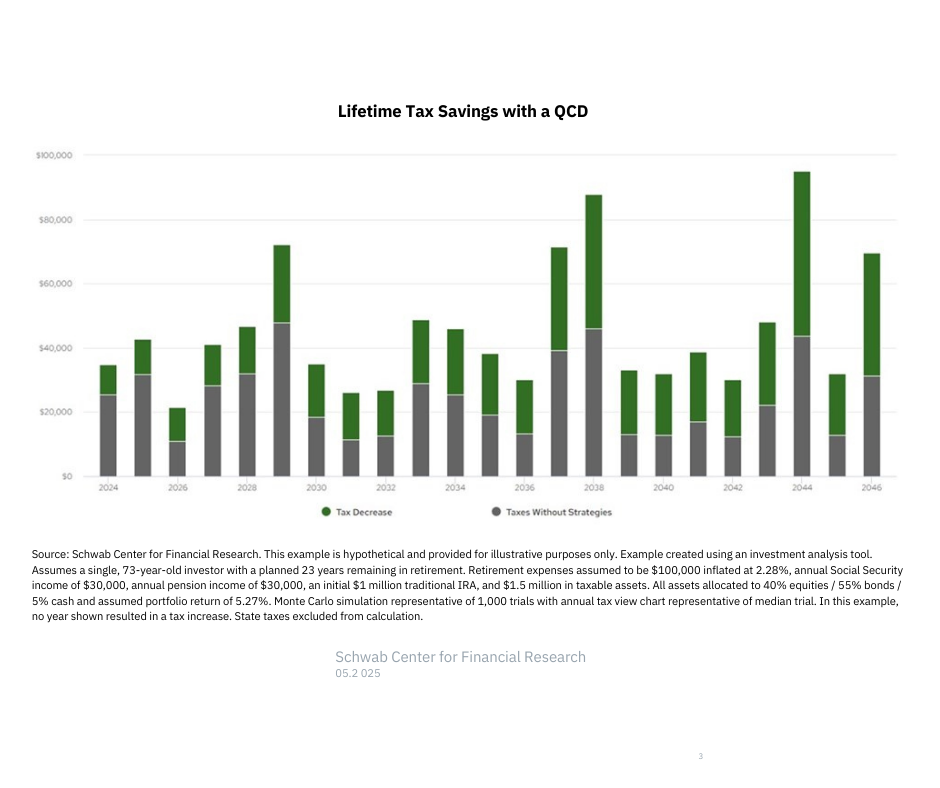

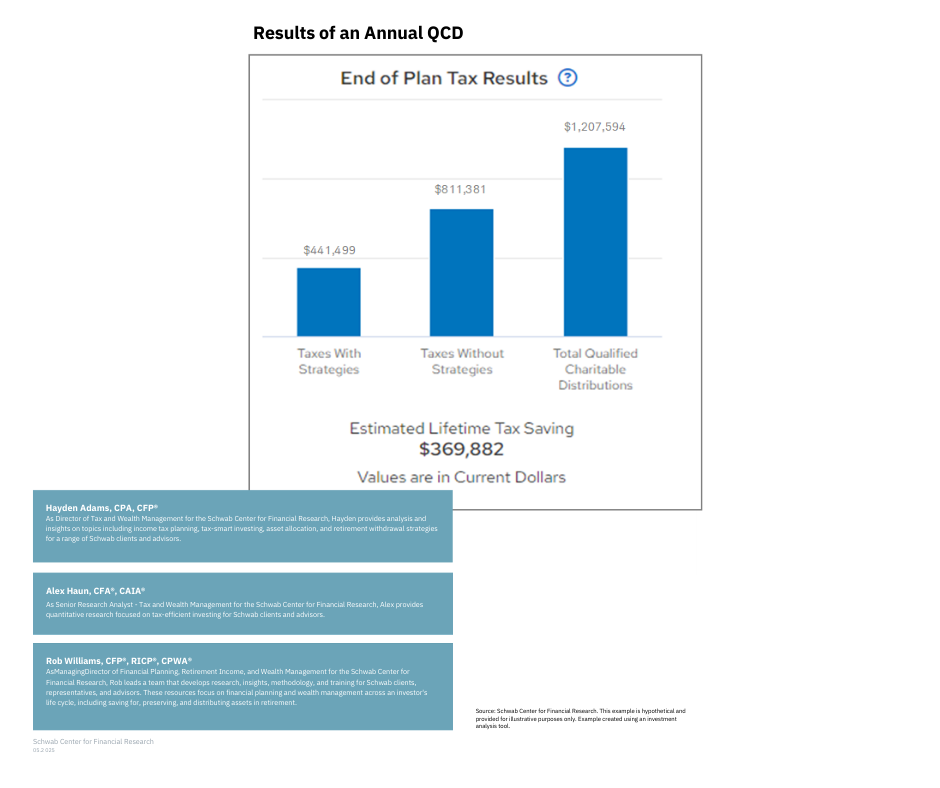

Consider Mark, a 73-year-old retiree with a $30,000 annual pension, Social Security income of $30,000 a year, $1.5 million in a taxable brokerage account, and $1 million in a traditional IRA. His pension, Social Security, and taxable assets are enough to support his lifestyle, and he would like to donate a generous amount to charity. Mark meets with a wealth advisor to see if a QCD could benefit him from a tax perspective. The wealth advisor performs an analysis through a Schwab Plan Comprehensive and determines that Mark can likely afford to eliminate or reduce his RMDs with a QCD for the rest of his life without negatively affecting his ability to sustain his lifestyle. This strategy could result in a tax savings every year for Mark by removing or reducing his RMDs from taxable income. The estimated lifetime tax saving of this strategy is $369,882 in current dollars (see the charts below and on page 4).

Bottom line

Individuals who are interested in helping a good cause and are at least ag 70 1/2 may want to consider a QCD. It can be a tax-smart way to donate, reduce taxable income, & satisfy IRA RMD requirements. Before initiating a QCD, talk with a wealth advisor and/or tax advisor.

Important disclosures

The information and content provided herein is general in nature and is for informational purposes only. It is not intended, and should not be construed, as a specific recommendation, individualized tax, legal, or investment advice. Tax laws are subject to change, either prospectively or retroactively. Where specific advice is necessary or appropriate, individuals should contact their own professional tax and investment advisors or other professionals (CPA, Financial Planner, Investment Manager) to help answer questions about specific situations or needs prior to taking any action based upon this information. All expressions of opinion are subject to change without notice in reaction to shifting market, economic or political conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Investing involves risk, including loss of principal. Diversification and asset allocation strategies do not ensure a profit and cannot protect against losses in a declining market. Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

IMPORTANT: The projections or other information generated by an investment analysis tool regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. This material is approved for retail investor use only when viewed in its entirety. It must not be forwarded or made available in part. The Schwab Center for Financial Research is a division of Charles Schwab & Co., Inc. The Charles Schwab Corporation provides a full range of securities brokerage, banking, money management and financial advisory services through its operating subsidiaries. Its broker-dealer subsidiary, Charles Schwab & Co., Inc. (member SIPC), offers investment services and products. Its banking subsidiary, Charles Schwab Bank (member FDIC and an equal housing lender) provides deposit and lending services and products. © 2025 Charles Schwab & Co., Inc. All rights reserved. Member SIPC. SCFR 0525-R55M

Financial Planning and Investment Advisory Services offered through Harvest Investment Services, LLC (“Harvest”),

dba Pyle Financial Services (“Pyle”), a Registered Investment Advisor. Registration does not imply a certain level of

skill or training. For more information about Harvest, or to receive a copy of disclosure Form ADV contact us or visit www.harvestinvestmentservices.com/disclosures/ or https://adviserinfo.sec.gov/firm/summary/159390

Past performance is no guarantee of future results. Information provided in this report is for educational and

illustrative purposes only and should not be construed as individualized investment advice. Pyle Financial and Harvest Investment Services, LLC is neither a law firm, nor a certified public accounting firm, and no portion of this report should be construed as legal or accounting advice.